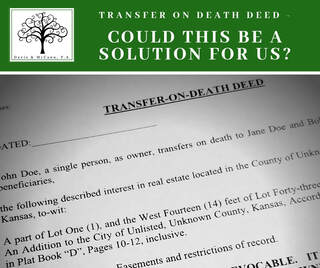

Thinking of getting remarried? Whether you are divorced or widowed, there’s quite a few things you should consider, in addition to whether you and your new love are ready for marriage. Couples with children from previous relationships should be especially mindful of how to provide a future that is fair for both a surviving spouse and the children, should one spouse die. Here are just a few of the things couples planning a second or subsequent marriage should consider: Tax consequences. Depending on the planning done with your prior spouse, certain tax advantages may be lost once you remarry, such as portability of a deceased spouse’s unused exemption. You should visit with your accountant prior to your remarriage to fully understand any tax implications your new marriage will have on your tax situation. Update your beneficiaries. How unfortunate would it be if an ex-spouse received some of your assets because you failed to update a beneficiary designation on your retirement or life insurance account? It is not sufficient to just declare your distribution plans in your will or trust. You must update your beneficiary designations to match your new estate plan. Your estate planning attorney can assist you with this step if you need help. Have a solid estate plan, IN WRITING. We cannot stress this enough. Put your wishes in a formal, written will or trust. If you have children, a simple will likely will not be sufficient, so look at creating a trust to address all the various needs of your blended family. Include a distribution list of personal items such as jewelry, photos, heirloom dishes and keepsakes. Without a written directive, your family heirlooms may not be passed along to your next generation, even if that was your verbal request. This is a great time to talk with your children about what items they consider emotionally important to them. Having a written plan, such as a prenuptial agreement, is one of the best ways to begin a secondary marriage. A prenuptial agreement will specify what is “yours”, “mine”, and “ours” and what will happen to the distribution of those items upon divorce or death. Because this agreement transpires BEFORE the marriage, much of the stress  You’ve been named as a beneficiary of someone’s Last Will and Testament! What does that mean and what can you expect? As a beneficiary, the Grantor of the will named you to receive something from their estate. It could be anything from cash, stock, investments, real estate, minerals, or a personal possession. An Executor is the person the Grantor named to be in charge of managing estate assets, paying estate bills, working with the estate accountant and attorney, distributing the estate assets, etc. This is the first person to whom you should address your questions about the estate. As a beneficiary, you have certain rights in the probate case. Here’s a few pointers on what you can expect from the Executor and the probate process: Executors have fiduciary duties and must put the interest of the estate before their own personal desires, even if they also are a beneficiary of the will. Although Executors are required to act prudently, many Executors lack the skills or knowledge they need to handle an estate administration. Without professional guidance from an experienced attorney, Executors can easily mishandle an Estate and be subject to monetary and legal ramifications. Executors must: 1. Put estate beneficiaries’ financial interests above their own; 2. Protect estate assets by preserving their value until final distribution; 4. Be impartial toward all beneficiaries regarding distributions; 5. Follow the instructions given in the will; 6. Keep good financial records of all estate account activities and provide a copy of these records to beneficiaries upon request; 7. Pay estate bills and beneficiaries when deemed appropriate by the Court or according to state law (creditors are paid before beneficiaries, so final distribution amounts may be lower than what is stated in the will); and 8. Communicate with creditors and beneficiaries pursuant to state law. Executors cannot:  Q: My grandfather has very few assets except his residence in Kansas. He would like his house to go to my mother upon his death. Is there any way the property can transfer to my mother without a probate? A: One of the easiest ways to accomplish this would be for your grandfather to execute a transfer on death deed to your mother. The transfer on death deed will transfer ownership of the property at your grandfather’s death, without probate, to your mother or any other person he names on the deed. How does the transfer on death deed work in Kansas? The property owner (the “Grantor”) executes a specific deed that names a successor beneficiary as the recipient of the property at the Grantor’s death. The deed is then signed before a notary and recorded with the Register of Deeds in the county where the property is located. The Grantor remains the legal owner while living. In addition, he may revoke the deed at any time prior to death by executing and recording a formal revocation or new deed with the county Register of Deeds. At the Grantor’s death, the person named as the beneficiary on the deed becomes the new property owner as soon as the Grantor’s death certificate is filed against the property. Advantages/Disadvantages of transfer on death deed: 1. The property will pass to the named person after Grantor’s death without an expensive and lengthy probate. 2. The Grantor retains ownership and control of the property so long as he/she is living. 3. The property passes to the new owner immediately after the Grantor’s death. No delay occurs in the transfer of ownership; only the recording of the Grantor’s certified death certificate with the county Register of Deeds is required. 4. A transfer on death deed also can be used to transfer mineral interests. 5. A transfer on death deed provides future flexibility and the ability to revoke or change beneficiaries.  Dementia is the term commonly used to describe a person’s decline in memory and other cognitive abilities that interferes with daily life. This decline is not a normal part of aging. Alzheimer’s, a brain disease that results in the loss of brain cells and function, is the most common cause of dementia. How can Alzheimer’s impact your legal future? If your cognitive ability decreases below a specific threshold set by the State, you no longer will be allowed to make legal decisions for yourself. If you have not executed Powers of Attorney while still mentally competent, the State will step in and decide who will make business and medical decisions on your behalf. The State will similarly decide how your estate will be divided upon your death, if you have not previously signed a valid will or trust. Predictably, the decisions made by the State may not be the decisions you would have made for yourself. Because Alzheimer’s is a progressive disease, it’s important to detect impairment issues as early as possible and get your business, medical and legal affairs in order. While Alzheimer’s currently has no cure, early treatment may slow memory loss and increase your chances of longer independence. Here are 10 warning signs from the National Institute on Aging indicating when a person may need a medical evaluation: 1. Difficulty remembering. Forgetting important dates or events, repeatedly asking for the same information, and relying on family members or reminder notes to handle daily tasks are clues that cognitive changes are occurring. 2. Difficulty in planning and solving problems. Struggling to track monthly bills, follow a familiar recipe, solve simple math problems, or taking longer than usual to complete these familiar tasks can be another indicator of problems. |

NEWS YOU CAN USEDavis & McCann, P. A., Archives

April 2021

Categories

All

|

RSS Feed

RSS Feed