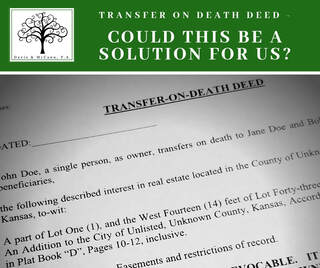

Q: My grandfather has very few assets except his residence in Kansas. He would like his house to go to my mother upon his death. Is there any way the property can transfer to my mother without a probate? A: One of the easiest ways to accomplish this would be for your grandfather to execute a transfer on death deed to your mother. The transfer on death deed will transfer ownership of the property at your grandfather’s death, without probate, to your mother or any other person he names on the deed. How does the transfer on death deed work in Kansas? The property owner (the “Grantor”) executes a specific deed that names a successor beneficiary as the recipient of the property at the Grantor’s death. The deed is then signed before a notary and recorded with the Register of Deeds in the county where the property is located. The Grantor remains the legal owner while living. In addition, he may revoke the deed at any time prior to death by executing and recording a formal revocation or new deed with the county Register of Deeds. At the Grantor’s death, the person named as the beneficiary on the deed becomes the new property owner as soon as the Grantor’s death certificate is filed against the property. Advantages/Disadvantages of transfer on death deed: 1. The property will pass to the named person after Grantor’s death without an expensive and lengthy probate. 2. The Grantor retains ownership and control of the property so long as he/she is living. 3. The property passes to the new owner immediately after the Grantor’s death. No delay occurs in the transfer of ownership; only the recording of the Grantor’s certified death certificate with the county Register of Deeds is required. 4. A transfer on death deed also can be used to transfer mineral interests. 5. A transfer on death deed provides future flexibility and the ability to revoke or change beneficiaries. 6. Not all states have laws allowing for the use of a transfer on death deed. 7. Because a transfer on death deed does not transfer property until death, for Medicaid eligibility purposes, the property remains the Grantor’s. Under current Medicaid laws, the property will remain exempt during the Grantor’s lifetime, so long as certain requirements are met. However, after the Grantor’s death, the property may become subject to recovery rules, depending on what State the Grantor resides in. Another option that your grandfather has, would be to deed the property to your mother, but maintain a life estate in the property. A deed with a life estate interest is a much older method of beneficiary planning and has some limitations that might not be as appealing as the transfer on death deed. Similar to the transfer on death deed, a life estate deed is a special deed form that gives the property to the Grantee (also called remainderman), but allows the property owner to continue to have full use of the property during his/her lifetime. With a life estate deed, the remainderman does not have any legal rights to possess the property while the Grantor is alive. How does the life estate deed work in Kansas? The property owner (the “Grantor”) executes a specific deed that names a successor (remainder beneficiary or remainderman) as the immediate recipient of the property. However, the Grantor retains the lifetime ownership and control of the property until his/her death. The deed then is signed, notarized and recorded with the county Register of Deeds. Advantages/Disadvantages of a deed with a life estate interest: 1. The property will pass to the beneficiary immediately, so an expensive and lengthy probate is not required. 2. The Grantor retains control of the property so long as he/she is living. 3. A deed with life estate interest also can be used to transfer mineral interests. 4. The deed is irrevocable. 5. Divorce, bankruptcy, sudden disability or death on the part of any one of the remainder beneficiaries can deeply complicate a life estate deed. 6. With a deed retaining a life estate interest, the full value of the property is not counted as an asset for the Grantor (after a five-year look back period) from a Medicaid eligibility aspect. Only the value of the life estate interest is counted as an asset, which is lower than the property value itself. A life estate deed is considered a gift for Medicaid eligibility purposes, and federal and state tax purposes. Beneficiary planning utilizing transfer on death deeds and deeds with life estate interests are meant for use with small estates. Even if you have a small estate, you should consult an experienced estate planning attorney to determine which estate planning tools are best for your unique circumstance. For more information on beneficiary planning, please contact Davis & McCann, P. A., Dodge City, KS. We are members of Wealth Counsel, a national consortium of Estate Planning Attorneys and the National Academy of Elder Law Attorneys (NAELA). We focus our practice on providing clients with the best legal advice on Estate Planning, Medicaid and Long-term Care Planning, Family Business/Small Business Succession Planning, Probate, Trust Administration, Real Estate Transactions, and related matters. Comments are closed.

|

NEWS YOU CAN USEDavis & McCann, P. A., Archives

April 2021

Categories

All

|

RSS Feed

RSS Feed